Paying in cash: more than the strange pastime of a few

First published as A report for Bank Machine, May 2009

First published as A report for Bank Machine, May 2009Reports of the death of cash are exaggerated. Here’s why

Three portents of a Britain without coins or banknotes

In recent months, three developments have – once more – raised the prospect of a cashless Britain:

1. In line with banks in France and Italy, Barclays has stepped up its drive to move consumers toward ‘contactless’ debit cards. By December, three million people who bank with Barclays will be able to touch rather than insert their cards in shops to make payments of up to £10 without a PIN. HSBC, Lloyds TSB, NatWest, RBS, Bank of Scotland and Halifax plan similar cards

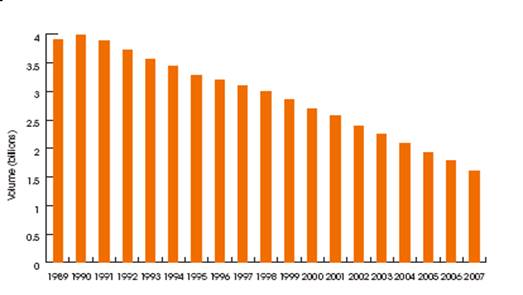

2. The payments association Apacs reported that Britons’ usage of cheques has halved, with adults writing out an average of just 1.4 a month compared with 2.9 a month in 1997. People receive only five cheques a year nowadays, compared with eight in 1997. (1) While cheques still figure in the paying off credit card bills and in person-to-person transactions such as gifts, Apacs says they’ll be used, in 2015, for less than one per cent of retail transactions. In that year, only five per cent of bills will be paid by cheque, compared with about 14 per cent today

Volume of cheques issued in the UK, 1997-2007

3. While the UK high street largely eschews cheques, and they have died out in the Netherlands, South Korea has moved still further toward a cashless society. Backed by the government, the country’s banks have agreed a single standard for payments made by Korean mobile phones. Since January, a single centre to handle all mobile transactions has been operating, and already 100,000 users are able to do without cash, all their old payment cards – and their travel cards, too. (2)

Predictions of a Britain without cash have been made before. But we shouldn’t be too cynical about their premature character: after all, though the paperless office and the leisure society have never arrived, banks do use a lot less paper than they used to, and people do have a lot more time and money for leisure than their parents once did. Which factors, though, are likely seriously to diminish the use of cash in Britain?

Asia’s pioneering of mobile payments will hasten the decline of cash…

The future of cash depends on economics, technology – and, perhaps even more, on sociology and politics. The future is never set in stone: it depends on how people choose to shape it. Long-run historical trends do favour automated payments and electronic money. However, the ageing of British society and the dislike of the British for overbearing corporate power will count against the complete collapse of cash. If people take an apathetic stance toward the vanishing banknote, then, about a third of a century from now, cash will get used for perhaps just 10 per cent of consumer transactions: it will be regarded as the strange, outmoded pastime of the few. If by contrast consumer preference for printed money proves much more durable, as we suspect, then the use of cash could run as high as, say, 25 per cent for a very long time.

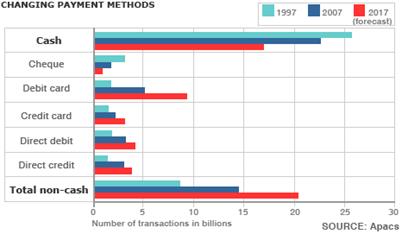

To get first sight of historic trends in payment methods, it’s worth looking at Apacs data on the years 1997 to 2007, and the Apacs forecast for 2017: (3)

In shops, and even among small firms and in person-to-person transactions, the use of cash has been slowly falling – even though cash transactions still outnumber non-cash ones. Apacs is probably right, however, to forecast that the decline of cash will now accelerate. Why? Because mobile phones are becoming much easier to use, and paying for things with them will shortly become easier too.

Here the example of Korea has a broader significance. Economically and culturally, the developing Asian influence on the world, deepened by the credit crunch, will over the years speed the take-up of mobile payment in the UK. The Japanese have made payments through mobile phones for some time, even if Japan today has big economic problems. But now China and India have forged ahead in mobile money:

- As early as 2007, China UnionPay, an arm of the country’s central bank that provides a nationwide electronic payment network, enabled eight million mobile users to buy insurance and book tickets with their phones, racking up £800m of payments in just 10 months (4)

- In late 2008, India’s IDBI Bank began offering its 3.5 million customers mobile payments. (5) This year, Citibank followed suit. (6)

More recently still, in Malaysia, Visa and Nokia, along with key local companies, launched the world’s first system for using mobile phones to make contactless payments in shops. (7)

Of course, mobile banking makes particularly good sense in developing countries, where banking systems are not as advanced as they are in the West. Yet mobile payment overseas promises to be influential in the UK: between 2004 and 2031, after all, net immigration will account for 4.1m of the 7.2m increase in the UK’s population – and many immigrant families will want to do some of their banking internationally, and will use mobile phones to do that. (8)

… but an ageing society will stop cash from being eliminated altogether…

For cost reasons, banks don’t like handling cash – though they are getting better at it. On the other hand, shops often do favour cash, because of the amount banks charge them for credit card payments. There’s no real magic attached to cash: the examples of Weimar Germany, and Zimbabwe today, show that paper promises to pay, held in people’s pockets, can be worth as little as the large-scale, hidden but toxic assets now held by British banks. Certainly a revival of inflation would devalue notes and coins. And as Ronald Reagan’s chief economic adviser Martin Feldstein has argued, when the US economy begins to recover, containing an inflationary explosion of money and credit in America, at least, ‘will not be an easy task’. (9)

This side of the Atlantic, UK government debt, and UK fiscal pressures, may in future make for inflationary pressure on cash. But right now lending is tight and cash is king. There are factors other than economics, however, that make the complete disappearance of cash hard to imagine – even in the long term.

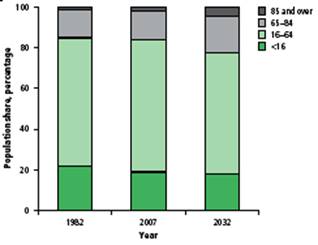

First, the social structure of Britain will ensure that cash retains more than a residual significance. Today, pensioners often prefer cheques to chip-and-pin technology and, even as Internet-capable mid-lifers grow old, they could well also retain the reflex of using cash. By 2032, for example, the numbers of people over 85 will double, reaching 3.1m, or four per cent of the total population:

Population age structure, 1982–2032, UK (10)

In 20 years’ time, today’s 60-somethings won’t at all have dropped cash for electronic methods. Only in something like a third of century away can we expect a sizable proportion of today’s 50-somethings to have completely abandoned cash. Then, in 2042, both the old and the middle aged will no doubt supplement a broad use of electronic methods with the occasional use of notes and coins.

… and British individualism will make use of cash something of a social statement

That the penetration of mobile phones in Britain has begun to slow reinforces the point just made. According to Deloitte, penetration, at 84 per cent of the UK populace, was at the end of January 2009 unchanged since July 2008. About nine million people don’t own a mobile, being ‘too young, too old, too infirm or too poor to use one’. Some people are also ‘simply not interested’ in having a mobile. (11)

Again, this suggests that, even 33 years ahead, paying by mobile phone won’t be a universal pursuit.

On top of that, Brits betray not just a growing fondness for debit cards, but also an affiliation to cash that’s rather special by European standards.

A few years ago, Apacs reported that more cash withdrawals are made in the UK than anywhere else in Europe – 2.7 billion during 2005, equivalent to an average of 42 withdrawals per person per year (Germany – 29.1; France – 20.3). Noting that, among large EU member states, the UK has the highest density of cash machines, Apacs wrote of Britons’ ‘love affair’ with them. The organisation went on to predict that, by 2015, 40 million Britons would regularly use cash machines, making more than 3bn withdrawals worth £245bn. (12) Today cash machines are by far the main source of cash withdrawals.

Even more than the demography and sociology of British payments in decades to come, though, the nation’s political psychology looks set to guarantee the retention of cash. For all its fondness for multiple credit and debit cards, and for all its serious credit card debt, the British public knows that money you can’t actually see has its defects (indeed, that’s why British consumers are at this moment mounting an aggressive drive to pay down credit card debt). The British public is also aware that to follow too much non-cash bank lending in the past with even more now is a dangerous course.

There are, too, wider and important forces that will underwrite the popularity of cash. If we think about the current revival of allotments, and the nation’s continued affection for gardens and ‘not in my back yard’, we’re reminded that the individualism of the British is likely to extend beyond these arenas, into the domain of payments. Of course, individualism here can take a non-cash form: since 2005, the online, peer-to-peer, cut-out-the-bank lending offered by London-based Zopa has given one example of this. (13) But in addition British individualism can extend to developing one’s own kind of cash. Since March 2007, Totnes, in South Devon, has run its own currency, the Totnes Pound, alongside Sterling. (14) Similarly in Lewes, East Sussex, 130 traders now accept the town’s 31,000 Lewes Pounds. (15)

While the initiatives of Totnes and Lewes are idiosyncratic, they hint at a deeper issue. In a world of image, fraud and deception, cash has an authenticity that’s just not matched by electronic money. In this sense, Britons may hang on to cash not just out of nostalgia, or even because of suspicion of other forms of finance, but rather out of a desire not to be too institutionalised, too branded, or too virtual. Cash will, then, live on not just as a store of value or a means of payment, but as a statement of what kind of person you are: freewheeling, not easily confined.

Over the coming decades, we can certainly expect a lot of progress in biometric methods of improving authentication in electronic payments. But on 5 July 1993, Peter Steiner, a cartoonist for the New Yorker, presciently and famously observed: ‘On the Internet, Nobody Knows You’re a Dog’. No matter what measures are taken to establish who is who in online money, that sense of unreality could very well still accompany the use of the Internet banking for decades.

There is one final aspect of British individualism that tells in favour of the continued presence of cash for many years to come. So long as worries about a ‘surveillance society’ persist in Britain, the anonymity that goes with using cash will appeal to groups wider than the criminal classes.

The British quest for authenticity has already become the focus of books. (16) But when someone like David Blunkett, previously Home Secretary for New Labour, brings himself to sound the alarm about Big Brother Britain, it’s clear that fears about too much eavesdropping on electronic communications have become quite widespread. (17)

Even if some CCTV cameras are dismantled, identity cards are dropped and the plan for a state database of telephone calls and emails is abandoned, fears will not be quelled easily. In the long term, they could ensure that, regardless of age, gender or ethnicity, people in Britain hang on to the cash habit.

Bank tellers will still field cash

After four decades, two British inventors won an Order of the British Empire for their role in pioneering the first electronic cashpoints in the years 1965-7. (18) Given the impact cashpoints have had so far, it would be easy to predict that, over the next 40 years, the Internet will effectively abolish cash. After all, in 2002, eBay paid no less than $1.5bn for PayPal, a company specialising in online electronic payments; and, to smooth the travel of tourists the London Olympics of 2012, Transport for London is researching at the option of allowing Oystercards to accept global standards for electronic payments, such as WorldPay. (19)

It would be easy, but it would be wrong. Yes, coins in particular may prove vulnerable to contactless payments, which will be limited to under £10. Yes, mobile phones will offer payments services wider and more sophisticated than those available from cards, and mobiles have already begun to play a role in parking. Yes, British holidaymakers in tomorrow’s exotic destinations may well prefer electronic money to carrying around wads of cash. But what strikes one about the magnetic stripe card in the UK is the relatively slow pace of change to date. (20) Retailers have often opposed change with conventional cards in the past, and may do the same with contactless ones in the future. (21)

Looking ahead 33 years, one must see past today’s vogue for bashing banks. Nevertheless, a complete bankers’ monopoly over the means of payment would undoubtedly inspire a plebian kind of revolt. Banks, or bodies like them – utilities, for example – would be able to do much more of the sharp practice that so often fills the pages of Which?, as well as those of the Sunday newspapers. Fees, charges, delays, rudeness: the exclusive use of electrons to transfer money might, in the imagination at least, exacerbate such tendencies.

Widespread unease about the abolition of Post Offices also suggests that, while the cashpoint will survive, so too will the bank teller. When tellers count out notes, one can always look them in the eye. In fact, the speed and richness of the informal, face-to-face conversations that can be had in bank branches will continue to make such locations a significant channel for payments, no matter how much banking is done at one’s desk, through the wall or on the move. Ears and voices, after all, are very efficient in dealing with information:

Speeds of human processing of words, by different means, words per second (22)

| Grasp of words… | through the eyes, reading print or a screen | 4.1-5.5 | |

| through the ears, listening to a voice | 5.0-5.8 | ||

| Output of words… | through the hands, using a | keyboard | 0.3-0.5 |

| pen | 0.5-0.7 | ||

| touch screen | 0.8-2.5 | ||

| through the voice | 3.3-6.7 | ||

Once the power of the voice is combined with the expressiveness of the face and body, only live, free, high-definition home videoconferencing will mount much of a challenge to bank tellers in future.

Ten years ago, before the dot.com boom was over, US banks could be found multiplying physical branches. It wasn’t just that they thought that ‘face time’ was the best way to establish and sustain the long-term relationships with customers. It wasn’t even that, in those days, US banks found it hard to get customers to move from browsing financial services online to actually buying them online. Rather, through face time, banks, like their customers, sought a recognition and social legitimacy each side felt it had lost, following years of public financial scandals and private consumer indebtedness.

When, in the UK, queues of customers looking to take out their cash formed around Northern Rock in 2007, it was clear once more that financial scandals prompt a flight to the folding stuff. In decades to come, with any luck, the mood should be lighter. Only a minority of British banks and global customers may want bank branches and face-to-face contact because they are desperate for interpersonal financial recognition and validation. People will go banking in the flesh, and will handle notes in bank branches, not for the therapy, but simply because the branch environment forms a convenient way to do business.

We shall see. Much depends on society’s attitudes to risk, and to the risks that are perceived to attach to each channel. In that light, the sense of certainty that accompanies the physical, hand-to-hand exchange of cash, conducted by familiar banking staff in a familiar local bank branch rather than online, will play a big part in preserving paper money.

Conclusion

Without cash, the crispness of new banknotes in an envelope given to a child on a birthday will be lost. Without cash, a friend may not always be able easily to help you out when you’re short in a social situation. Without cash, some of the sense of British identity that goes with notes of different denominations and designs – including Scottish banknotes – would disappear.

Tipping would be harder. Gambling might become an all-or-nothing affair. Pocket money would be more fraught than ever. In the workplace, whip-rounds would be still more complicated. On the street, buying from stalls and giving money to charity would be a hassle.

When we look at what a completely cash-free society would amount to, then, the scope for popular alienation from corporate- or state-backed electronic methods is considerable. An interesting question is also raised by the spread of employers paying employees electronically. There may prove to be limits to this practice in years to come.

Our forecast of cash being reduced to between 10 and 25 per cent of transactions in future is loose because, to repeat, the future is something that people make happen, rather than just something that happens to people. The demise of cash is by no means pre-ordained. The scale of popular resistance to the unseen forces surrounding electronic money should not be underestimated.

Except in the case of forged notes, you know where you are with cash. And nearly all the time, people are right to think they know where they are with electronic money. However fear is a powerful force in society, and people will go to some lengths to assuage it. One could even propose that a truly cashless Britain will only emerge, not just when the technology is right, but also when today’s fears really do become a distant memory.

References and footnotes

1. Apacs, The Great British Cheque Report, 11 February 2009, p15.

2. John Sudworth, ‘S Korea ready to hang up on cash’, BBC News, 13 February 2009.

3. Apacs data, quoted in Kevin Peachey and Carolyn Rice, ‘Dying cheques mark changing times’, BBC News, 17 February 2009.

4. Xinhua, ‘Mobile phones become virtual banks for 8 mln Chinese consumers’, People’s Daily Online, 23 November 2007.

5. ‘IDBI ties up with PayMate’, The Hindu Business Line, 18 December 2008.

6. ‘Citibank launches Citi Mobile’, The Hindu Business Line, 13 March 2009.

7. Visa, ‘Visa Makes NFC Mobile Point-of-Sale Payments Commercially Available for the First time’, 9 April 2009.

8. Figure from Office for National Statistics (ONS), Population Trends, No123, Spring 2006, Table B, p15. See also Deborah J Ball and Michael S Rendall, ‘Immigration, emigration and the ageing of the overseas-born population in the United Kingdom’, in ONS, Population Trends, No 116, Summer 2004, pp18-27.

9. Martin Feldstein, ‘Inflation is looming on America’s horizon’, Financial Times, 19 April 2009.

10. Karen Dunnell, ‘Ageing and mortality in the UK – National Statistician’s Annual Article on the Population’, Table 2, p9, in ONS, Population Trends, No 134, Winter 2008.

11. Deloitte, ‘Total mobile – the Digital Index’, 2009.

12. Apacs, Press release, 14 September 2006.

13. See http://uk.zopa.com/ZopaWeb/public/about-zopa/about-zopa-home.html

14. The aim is for the local community to go about ‘creating a future that addresses the twin challenges of diminishing oil and gas supplies and climate change’ and become ‘more self reliant in areas such as food, energy, health care, jobs and economics’. See http://totnes.transitionnetwork.org/

15. See Jack Izzard, ‘Barter economy’, Radio 4 Today, 24 January 2009. The Lewes Pound was launched at a 450-strong meeting, held in September 2008 and addressed by the local mayor and Guardian columnist Polly Toynbee. See http://transitiontowns.org/Lewes/LewesPoundArchives

16. See for example James H Gilmore and B Joseph Pine II, Authenticity: what consumers really want, Harvard Business School Press, 2007.

17. Andrew Grice, ‘Blunkett warns over “Big Brother” Britain’, The Independent, 23 February 2009.

18. James Goodfellow, a development engineer with Smiths Industries, invented and in 1966 patented a system comprising a machine-readable encrypted card and a numerical keypad, into which an obscurely related Personal Identification Number was entered manually. Chubb made the housings and the cash-dispensing systems for the electronic ATMs. John Shepherd-Barron, a Scots inventor and managing director of De La Rue Instruments, oversaw the first operational electronic ATM. Installed in Enfield, north London, its first user was the actor Reg Varney. For the controversy over who really invented the ATM, see A W Miller, ‘Who invented the ATM machine? It depends on who you ask!’

19. Angelica Mari, ‘Cashless plans need retailer buy-in’, Computing, 9 April 2009.

20. See James Woudhuysen, ‘Chequeless, cashless, clueless in the smart card society’, Management Today, November 1990, and Woudhuysen, ‘Banking on IT’, IT Week, 26 June 2006.

21. Mari, op cit.

22. Source: human factors specialist Barry Drake, private communication.

@jameswoudhuysen I use my bicycle every day. Exercise and access to shopping without any parking meters and all that fuzz. But alfa-cyclists are the worst. They are competing at 40 mph and always acting rudely to get where they are going.

A PRO-CAR CYCLIST WRITES: 12-1pm tomorrow on #R4, will be talking bikes, cars, pedestrians, public transport – and #JeremyVine

Stimulating piece on the #CrisisOfCustomerService by clever @ClaerB @FT.

All that Clinton-era #CustomerExperience guff was always for the birds - certainly compared with, er, price.

The new thang? Often there is NO service - and thus no #CX!

Articles grouped by Tag

Bookmarks

Innovators I like

Robert Furchgott – discovered that nitric oxide transmits signals within the human body

Barry Marshall – showed that the bacterium Helicobacter pylori is the cause of most peptic ulcers, reversing decades of medical doctrine holding that ulcers were caused by stress, spicy foods, and too much acid

N Joseph Woodland – co-inventor of the barcode

Jocelyn Bell Burnell – she discovered the first radio pulsars

John Tyndall – the man who worked out why the sky was blue

Rosalind Franklin co-discovered the structure of DNA, with Crick and Watson

Rosalyn Sussman Yallow – development of radioimmunoassay (RIA), a method of quantifying minute amounts of biological substances in the body

Jonas Salk – discovery and development of the first successful polio vaccine

John Waterlow – discovered that lack of body potassium causes altitude sickness. First experiment: on himself

Werner Forssmann – the first man to insert a catheter into a human heart: his own

Bruce Bayer – scientist with Kodak whose invention of a colour filter array enabled digital imaging sensors to capture colour

Yuri Gagarin – first man in space. My piece of fandom: http://www.spiked-online.com/newsite/article/10421

Sir Godfrey Hounsfield – inventor, with Robert Ledley, of the CAT scanner

Martin Cooper – inventor of the mobile phone

George Devol – 'father of robotics’ who helped to revolutionise carmaking

Eugene Polley – TV remote controls

Thomas Tuohy – Windscale manager who doused the flames of the 1957 fire

0 comments