Chinese consumer markets cannot be turned back

First published by Geopolitical Information Service, 24 February 2016

First published by Geopolitical Information Service, 24 February 2016Can China develop a coherent, vibrant internal market and break its dependency on large state-owned industries? The country has made substantial progress over the past 20 years; and despite current concerns about the stability of its economy, there are good reasons to believe it will continue to do so.

Retail sales growth in China is accelerating again after a slowdown, and over the longer term the shift in consumer tastes toward Western-style goods will continue. Domestic producers of goods and services are gradually learning to cater to those preferences and compete on branding and design rather than just price.

Like everything else about Western commentary on China, that on its consumers has a tendency to swing to extremes. On the one hand there is plenty of absurd pessimism which suggests that there is something about the Chinese which will ensure that, after decades of breakneck economic growth, they will never attain prosperity based on consumption.

On the other hand, Western business doesn’t just now depend a lot on the current volume of Chinese consumer expenditure, which was $3.4trillion in 2014 (US: $11.4tr in 2013; Germany, $2.1tr in 2014). Future prospects are also good. Thus the Demand Institute, a think-tank jointly run by the Conference Board and Nielsen in the US, believes that if policymakers in Beijing are successful in increasing national consumer expenditure, a market worth an astonishing $64trillion will open up by 2025.

There’s more difficulty to follow. Like everything else about statistics on China, those on its consumption are vigorously contested. And on top of that, let’s recall two often neglected points about consumption in general.

Clearing the air about consumption in general

First, because of its long rise (not least in housing) and the fact that everyone is engaged in it, consumer expenditure has had an exaggerated effect on the Western economic imagination. For that reason, some commentators believe that the prospects for global economic growth hinge not just on China, but specifically on the fate of Chinese consumer spending – whether it can take off and so rescue the world’s second-largest economy from slowing growth.

That’s ridiculous. It’s wrong directly to connect China’s faltering stock markets with its whole economy. By the same token it’s wrong to take the drop in the growth of China’s booming retail market – from 17 per cent in 2011 to about 10 per cent in 2015 – as spelling doom for the world economy.

Second, and relatedly: the usual ‘expenditure measure’ of GDP only computes the demand for final goods and services. Take energy, for example – important, among other consumer uses, for the room-by-room home air filtration units China’s heavy pollution today demands. Worldwide, GDP includes goods and services, such as energy, delivered to the consumer in the home; but, to avoid double counting, it excludes intermediate inputs such as supplying energy to businesses. Yet doing the latter absorbs resources just as much as making energy for consumers. Once intermediate inputs are taken into account, corporate and government spending vastly exceeds the consumer sort.

So before we rush to say that China is decades away from creating a ‘consumer society’, we need to remember that, in economic terms at least, even Americans don’t live in one.

So what’s the real picture of consumption in China?

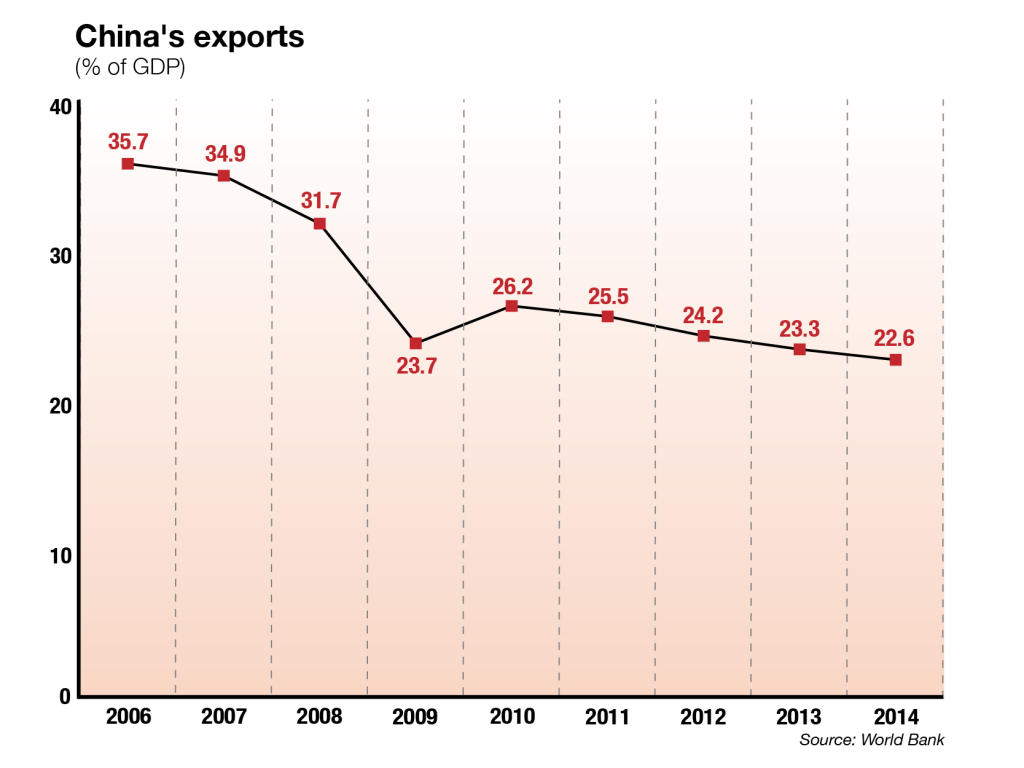

GDP is less export-led – while consumption has proved a stable pillar

China has long left behind its reliance on exports for growth. Of course, exports, which are measured as sales revenues, cannot be compared with GDP, which is a measure of value added. Nevertheless, the move away from exports is unmistakable:

Export revenues compared with GDP as percentages

Source: The World Bank

It’s true there was a ramp upwards in these percentages over the years 2001-5 – from 20 to 34 per cent. But as the world economy has suffered since the Crash of 2008, so China’s exporters have hit trouble – even if the domestic economy’s growth has, until quite recently, made up for shortfalls in overseas sales. In this limited respect, therefore, magnifying the significance of Chinese consumption has some basis in fact.

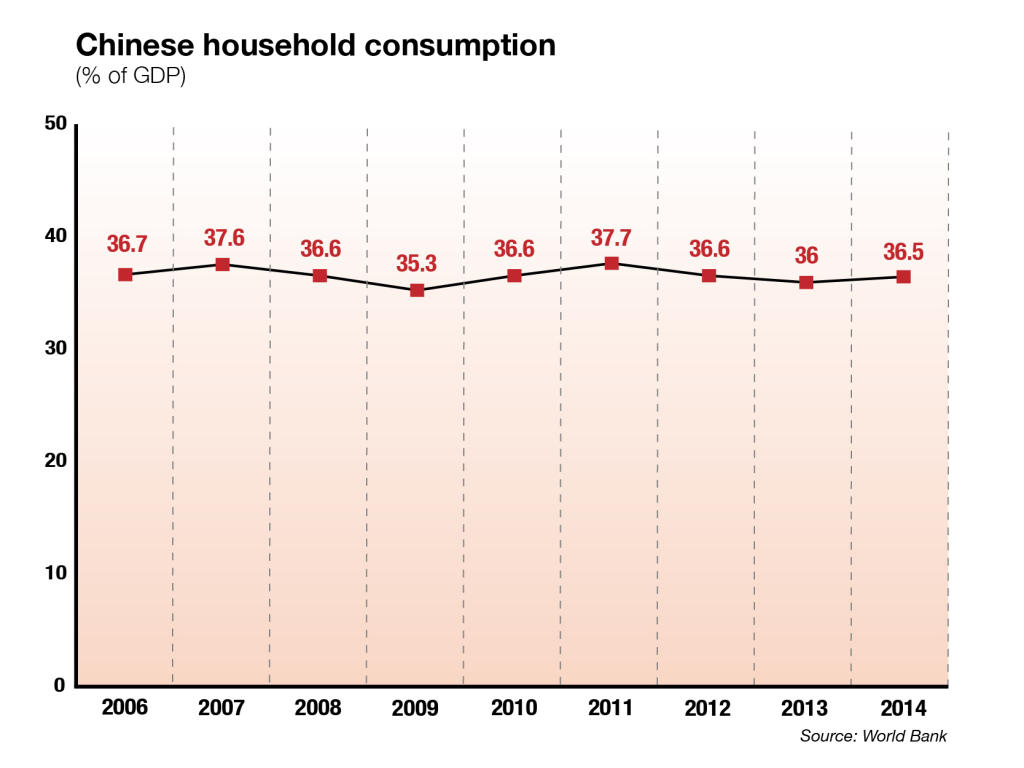

Here, by contrast, are the figures for consumption as a percentage of GDP:

Household final consumption expenditure as a percentage of GDP

Source: The World Bank

Two things are striking about these statistics. First, they’re very constant over time – something that suggests that consumption, though intimately linked with overall GDP growth, is a resilient part of China’s political economy. Second, there’s obviously considerable potential for expansion. It’s true that the Demand Institute’s figure for Chinese consumption as a percentage of ‘real’ GDP is lower than that of the World Bank – 28 per cent in 2011, as against nearly 40 per cent. But whatever the true picture in China, it remains a consumer infant when compared with the consumer grown-ups of Japan and Germany (about 60 per cent in 2011, according to the Institute), and, even more, the US (76 per cent).

Beyond cars, urban durables markets are fairly saturated, but luxuries are bought abroad

One should not get too excited about today’s unmet potential for further consumption. A glance at ownership of durables in China shows that, with the important exception of motor transport, levels of market penetration among urban households, at least, are quite high – and rising pretty fast:

Penetration of durables in urban and rural households, per cent

|

Urban |

Rural |

|||

|

2013 |

2014 |

2013 |

2014 |

|

| Car |

22.3 |

25.7 |

9.9 |

11.0 |

| Motorbike |

20.8 |

24.5 |

61.1 |

67.6 |

| Electric bike |

39.0 |

42.5 |

40.3 |

45.4 |

| Washing machine |

88.4 |

90.7 |

71.2 |

74.8 |

| Fridge |

89.2 |

91.7 |

72.9 |

77.6 |

| Microwave |

50.6 |

52.6 |

14.1 |

14.7 |

| TV |

118.6 |

122.0 |

112.9 |

115.6 |

| Air conditioner |

102.2 |

107.4 |

29.8 |

34.2 |

| Mobile phone |

206.1 |

216.6 |

199.5 |

215.0 |

| PC |

71.5 |

76.2 |

20.0 |

23.5 |

Source: National Bureau of Statistics of China, China Statistical Yearbook 2015, Tables 6.11 and 6.16, on http://www.stats.gov.cn/tjsj/ndsj/2015/html/EN0611.jpg and http://www.stats.gov.cn/tjsj/ndsj/2015/indexeh.htm

In China at present, to buy a car means finding the equivalent of at least a year’s wages. There’s also little chance of supporting such a purchase through personal debt: the country’s undeveloped household finance system largely prevents that. However, with rural migration toward richer lifestyles in the cities still continuing, and remaining rural market penetrations generally much lower than urban ones, there remains everything to play for.

Another snag has emerged around the $15bn luxury goods market. Worldwide, China accounts for the largest share of worldwide spending on luxury goods – 31 per cent. However, China’s shiny new luxury shops, as any visitor knows, are often empty. Among China’s rich, levels of saturation have often been breached; and, among its middle classes, the preference is often to buy abroad, where, aided by the devaluation of the renminbi in August 2015, prices are often nearly a third lower than at home.

For all these barriers, though, sales in many categories of retail goods remain buoyant, despite the slowdown in GDP growth. Take that staple of Western urban life – the coffee bought on the way to work. In China, that’s still a bit of a luxury, even for the relatively affluent; but Starbucks, which boasted 1900 outlets in 2015, is on track to run 3400 by 2019.

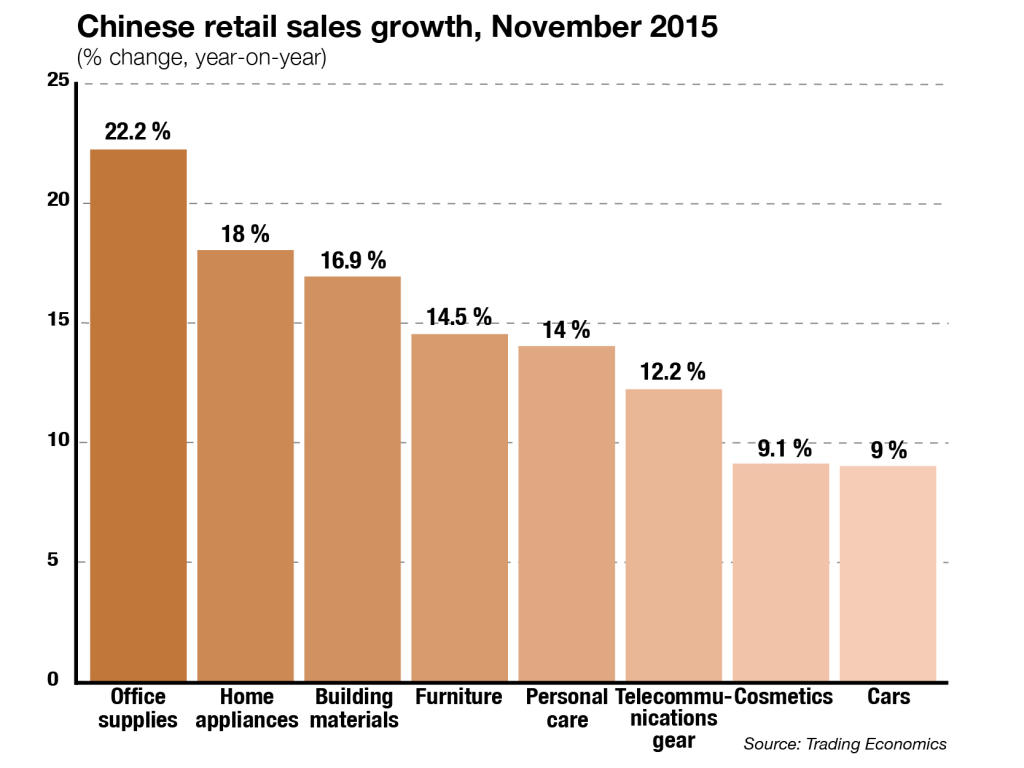

Overall, in November 2015 (the latest month for which figures are available), retail sales in China were up 11.2 per cent on the previous year – the highest monthly rise since December 2014. The increases in some categories tell a story of rising affluence, especially with regard to homemaking (including, it seems, the making of home offices):

Rise in retail sales, November 2014 – November 2015, per cent

Source: Trading Economics

There are other bright spots, too. In China, e-tail transactions take about 10 per cent of total retail sales – a figure that compares well with the UK, which boasts one of the world’s biggest inclinations toward consumer buying online. Thus, in 2015, China’s Singles Day (the eleventh of November, or 11.11) saw the national e-commerce giant Alibaba rake in a record $14.3bn in sales, 60 per cent up on the year before; indeed Alibaba’s figure alone dwarfs that for the whole of the US over Cyber Monday (30 November), which in 2015 reached a record but, by Chinese standards, relatively modest $3.1bn. Chinese m-commerce is also on the up, with smartphones used for the office delivery of food, and even in street market purchases of food.

The simple fact is that Chinese consumers now have their appetites, as well as Western ones, too. The latest Star Wars film, for instance, took $53m on its first weekend in China, the country’s highest figure for an opening weekend. Projections hold that movie-going will generate revenues of $10bn in a few years. Looking at discretionary spending more generally, McKinsey estimates that personal goods, recreation, education, transport and communication will enjoy compound annual growth rates of 7.6 per cent over the period 2013-30.

The geography of Chinese consumer spending

Back in 2000, urban households were spending 3.7 times as much as rural ones. By 2014, however, that ratio had fallen to 2.9. Clearly consumption in the countryside is engaged in a slow convergence with that in cities.

In terms of regions and provinces, the picture with consumption more resembles an East-West divide than a North-South one – but again the gap appears to be closing. For all households, urban and rural, the money spent and the increases in it between 2013 and 2014 are as follows:

Consumer spending by region and province, 2014, current RMB, and increase over 2013, constant prices, per cent

|

Spending (RMB) |

Increase (%) |

|

| North | ||

| Beijing |

36,057 |

4.7 |

| Tianjin |

28,492 |

6.9 |

| Hebei |

12,171 |

9.4 |

| Shanxi |

12,622 |

5.0 |

| Inner Mongolia |

19,827 |

8.7 |

| Northeast | ||

| Liaoning |

22,260 |

8.7 |

| Jilin |

13,663 |

5.5 |

| Heilongjiang |

15,215 |

16.1 |

| East | ||

| Shanghai |

43,007 |

7.3 |

| Jiangsu |

28,316 |

11.9 |

| Zheijiang |

26,885 |

7.3 |

| Anhui |

12,944 |

7.0 |

| Fujian |

19,099 |

7.9 |

| Jiangxi |

12,000 |

10.1 |

| Shandong |

19,184 |

10.1 |

| South Central | ||

| Henan |

13,078 |

8.6 |

| Hubei |

15,762 |

10.8 |

| Hunan |

14,384 |

9.2 |

| Guangdong |

24,582 |

8.3 |

| Guangxi |

12,944 |

7.6 |

| Hainan |

12,915 |

8.7 |

| Southwest | ||

| Chongqing |

17,262 |

11.1 |

| Sichuan |

13,755 |

8.4 |

| Guzhou |

11,362 |

13.1 |

| Yunnan |

12,235 |

7.7 |

| Tibet |

7,205 |

11.3 |

| Northwest | ||

| Shaanxi |

14,812 |

10.1 |

| Gansu |

10,678 |

10.8 |

| Qinghai |

13,534 |

9.7 |

| Ningxia |

15,193 |

11.7 |

| Xinjiang |

12,435 |

7.0 |

Source: National Bureau of Statistics of China, China Statistical Yearbook 2015, Table 3.20

Despite plenty of differences within regions, the overall pattern is clear. As we might expect, prosperity is evident in booming provinces such as Beijing, Shanghai and its coastal neighbours, and Guangdong. In the southwest and northwest, by contrast – and especially in Tibet – consumption is modest. However, several provinces within these regions, including Tibet, recorded sizable increases in consumption in 2014, as has Heilongjiang in the far northeast.

The question of domestic brands

Chinese consumers’ mantra when selecting products used to be ABC: ‘Anything But Chinese’ goods. Outside of cars, where foreign brands completely dominate, is that still the case?

For everyday life, Chinese products are thought good enough, including in sectors such as white goods. But for anything special, the Chinese middle classes and rich people tend to prefer foreign goods and services. Recently, too, young consumers have begun to shop online using overseas suppliers. That will make life tougher for domestic firms trying to meet consumer demand.

The picture is not all bleak. Take holidays, for instance. According to Professor Chris Ryan at the University of Waikato, New Zealand, ‘the major determinant of growth in Chinese tourism has been the domestic market place. The domestic Chinese tourism industry has boomed with growing incomes and car ownership combined with better internal air and rail services’. The China Tourism Academy estimates that about four billion domestic leisure trips were taken last year, proof that Chinese services still have plenty of attractions for Chinese consumers.

The wider question here is how fast Chinese consumer suppliers can begin to match Western ones in terms of marketing, branding, and design. Here, progress looks like being gradual.

Chinese consumers don’t just require more products, but better ones. At the moment, however, most Chinese companies are not ready for this. For three decades, the habit has been to make things cheaper; making them very much better has been beyond many firms’ capabilities.

The problem doesn’t just exist in manufacturing. Most Chinese firms know how to research consumers, communicate with them, design for them, and establish a strong brand with them. As brand replaces price as the measure of success, market competition will squeeze out many of the weaker players.

It seems unlikely that China’s lumbering state-owned enterprises (SOEs) could ever supply consumer goods and services with the competence shown by private companies. Quite recently, Beijing has indicated its desire to shake up SOEs by getting them to hold an interest in private companies, and vice versa. However, such measures alone won’t at all guarantee that SOEs take on board consumer requirements and sensibilities. Worse, SOEs are so powerful in China that partnerships between them and the private sector are likely to have very different dynamics from those that have accompanied private/public partnerships in the West. In Britain, a pioneer in the field, the private sector broadly had the public sector for breakfast over procurement and contracts. In China, by contrast, the state is so powerful that local administrations find it difficult to engage private companies in cooperation, because the latter fear that the former will renege on contracts. It’s pretty certain that this knot will not, in a hurry, be untangled to the benefit of consumers.

Conclusion

In the Financial Times, one blogger attacks ‘the idea that consumer spending is somehow independent of the wider slowdown and can act as a countervailing force’. He continues: ‘The concept of a painful, but ultimately successful, rebalancing process for China, where industry and investment slow but consumer spending accelerates, does not, therefore, stack up’.

Clearly consumer spending is far from independent of China’s wider slowdown. Yet to carry on about such reputed independence is to attack a straw man. Short of a domestic political crisis and/or a world financial crisis, the Chinese economy will develop faster than economies in the West, and Chinese consumption will move ahead accordingly.

That a rebalancing process is already underway is suggested by the contribution of the tertiary, services sector to GDP growth. After the usual collapse in the wake of the Crash of 2008, services – especially financial services, but also services in healthcare and education – now contribute more to GDP growth than the manufacturing or secondary sector, something they’ve only done once before, in 2001:

Contribution of secondary and tertiary sectors to GDP growth, constant prices, per cent

Year Secondary Tertiary

2010 57.2 39.2

2011 51.5 44.3

2012 49.3 45.4

2013 48.0 47.6

2014 47.1 48.1

Source: National Bureau of Statistics of China, China Statistical Yearbook 2015, Table 3.7

To sum up: China will slowly but surely develop its internal market, both for producer goods and services, and for consumer ones. In the latter category, the longstanding Chinese proclivity for precautionary savings – especially to guard against the cost of healthcare – will for some years but a brake on consumer spending. New health insurance schemes may help matters, but for the present remain shallow.

Chinese consumers should neither be underestimated, nor overestimated.

By themselves, consumers will not rescue the Chinese economy from slowing growth. But the economy is headed in their direction. History will not be wound back.

@jameswoudhuysen I use my bicycle every day. Exercise and access to shopping without any parking meters and all that fuzz. But alfa-cyclists are the worst. They are competing at 40 mph and always acting rudely to get where they are going.

A PRO-CAR CYCLIST WRITES: 12-1pm tomorrow on #R4, will be talking bikes, cars, pedestrians, public transport – and #JeremyVine

Stimulating piece on the #CrisisOfCustomerService by clever @ClaerB @FT.

All that Clinton-era #CustomerExperience guff was always for the birds - certainly compared with, er, price.

The new thang? Often there is NO service - and thus no #CX!

Articles grouped by Tag

Bookmarks

Innovators I like

Robert Furchgott – discovered that nitric oxide transmits signals within the human body

Barry Marshall – showed that the bacterium Helicobacter pylori is the cause of most peptic ulcers, reversing decades of medical doctrine holding that ulcers were caused by stress, spicy foods, and too much acid

N Joseph Woodland – co-inventor of the barcode

Jocelyn Bell Burnell – she discovered the first radio pulsars

John Tyndall – the man who worked out why the sky was blue

Rosalind Franklin co-discovered the structure of DNA, with Crick and Watson

Rosalyn Sussman Yallow – development of radioimmunoassay (RIA), a method of quantifying minute amounts of biological substances in the body

Jonas Salk – discovery and development of the first successful polio vaccine

John Waterlow – discovered that lack of body potassium causes altitude sickness. First experiment: on himself

Werner Forssmann – the first man to insert a catheter into a human heart: his own

Bruce Bayer – scientist with Kodak whose invention of a colour filter array enabled digital imaging sensors to capture colour

Yuri Gagarin – first man in space. My piece of fandom: http://www.spiked-online.com/newsite/article/10421

Sir Godfrey Hounsfield – inventor, with Robert Ledley, of the CAT scanner

Martin Cooper – inventor of the mobile phone

George Devol – 'father of robotics’ who helped to revolutionise carmaking

Thomas Tuohy – Windscale manager who doused the flames of the 1957 fire

Eugene Polley – TV remote controls

0 comments