China struggles to engineer robot revolution

First published in China Outlook, July 2013

First published in China Outlook, July 2013Just as China’s strengths in cyberwar have stirred Western perceptions of a nation on the move, so its talents in robotics could be the stuff of nightmares. On the surface, recent developments do suggest growing Chinese prowess in the use and the construction of robots. As in other countries, however, the march of robots in China will take decades, not years.

To China buffs in the West, two recent developments stand out as signals of China’s growing interest in robots. The first was the opening in June 2012 of the Robot Restaurant, Harbin, in northeast China’s Heilongjiang province. The eating-house boasted robot ushers, robot chefs and robot waiters scooting around on tracks. Each was made for RMB 2-300,000 by Harbin Haohai Robot Company.

The second development came in June of 2013, when the CEO of Taiwan-based Foxconn Technology Group, Terry Gou, clarified a boast he had first made back in July 2011. Gou said that Foxconn, which employs more than a million workers in China, would now install a million robots not by 2014, as he had first forecast, but as a ‘middle-to-long-term goal’. Despite his less exacting schedule for introducing robots, Gou’s reason for backing them was familiar enough: wages in China are rising.

In each case the hype outran the substance. Little money will be made in return for the substantial investment that has been poured into the Robot Restaurant. At the same time, the level of wages is not the only factor that determines the pace of robot adoption, nor are Foxconn’s current generation of robots without their critics. From the Control and Robotics Laboratory at the École de technologie supérieure (ÉTS) in Montreal, professor Ilian Bonev, though more than sympathetic to the growth of Chinese robots, reports that top Chinese specialists in robotics are unfamiliar with Foxconn’s machines, and himself opines: ‘I haven’t seen a Foxbot design… that is original’.

Behind the hype, though, there is some real progress. By installing 23,000 robots in 2012, China maintained its lead over America (22,400) and began to approach the total notched up by Japan (28,700). Indeed next year, forecasts have it, the number of robots newly installed in China will surpass that newly installed in Japan. Although the chief applications for robots in China have been in welding and handling operations, the growth in assembly robots since 2009 has been especially fast.

The spread of deft and precise assembly robots is good news for China. In terms of internationally traded goods, the world market values the nation’s intricate consumer electronics and IT more than its vehicles. However, robots are also more and more used in China for the production of food, drink, and plastics assemblies.Over the longer period since 2005, the general growth of robot sales in China has also been rapid. While the average annual rate of growth of installed industrial robots runs at about nine per cent for the whole world, annual sales in China have grown much faster – by about 25 per cent on average per year.

That’s all very encouraging. So, too, is the growth of indigenous Chinese forces designed to nurture robotics. To date, the main suppliers to China have been the ‘big four’ foreign names in robotics, which hail from Japan (FANUC, Yaskawa Electric Corp), Germany (KUKA) and Sweden (ABB). Each of these manufacturers sold more than 3000 robots in 2012. However, in Guangzhou, GSK CNC Equipment Co., Ltd, aims to use its ample client base in machine tools to up its output of robots, painted in orange, from 1000 in 2013 to 10,000 in 2015. Meanwhile Estun Robotics, based in Nanjing, makes yellow robots weighing between 5 and 300kg: its smallest machine claims a precision of 0.04mm.

Perhaps the most ambitious venture, however, is taking place in Liaoning Province – like Harbin, in northeast China. There, over 5km2 of land in Shenfu New Town, a low-tax development zone, Fushun City hopes to put in a complete base for manufacturing robots by the end of 2017, going on to add academies and labs for robot development after that. Zhao Qibin, deputy director of Fushun City’s management committee, claims that will be the country’s largest robot industrial base by 2030.

These plans at the level of individual firms are paralleled by institutional changes. In Beijing, the China Machinery Industry Federation (CMIF) set up the China Robot Industry Association, whose 77 members embrace both companies and research institutes. Clearly robots in China are beginning to move at a marching pace. Yet as Wang Ruixiang, president of the CMIF, has put it, China’s own robot sector ‘faces an urgent task of enhancing product quality and achieving sustainable development’. Accounting for less than nine per cent of shipments in 2012, native makers of robots in China have yet to achieve a brand reputation, or a supply-and-demand dynamic, of their own.

According to Morgan Stanley, China is by international standards severely under-equipped in robots: usage has historically been 60% below the international average. Yet it is foreign suppliers more than domestic ones that are poised to take advantage of the nation’s robot gap.

Take the plans of Yaskawa. In June, it announced plans to establish its first factory for making robots outside Japan, in Changzhou, Jiangsu province. The RMB 300m plant, which will be aimed at automotive manufacturers, will be the largest for making robots in the world, turning out 6000 machines at the start, rising to double that in fiscal 2015.Yaskawa is not alone. Nachi-Fujikoshi Corporation began robot production in Zhangjiagang, also in Jiangsu province, earlier this year. By the end of 2013, Germany’s KUKA will unveil a new a robot-making facility in Shanghai.

China’s own robots are cheaper than those made by its rivals, but as yet are not as easily programmable. With the output numbers that are also planned by foreign interlopers, native robot makers have a struggle on their hands. At the same time, however much wages rise in China, the talent to install, repair, maintain and generally reconfigure a whole enterprise around new robot-centered manufacturing cells may not be too forthcoming. Even in America, there’s a shortage of expert roboticists. The same labour shortages in China that are evoked as prompting a groundswell of investment in robots may also impair China’s ability actually to engineer its own robot revolution.

@jameswoudhuysen I use my bicycle every day. Exercise and access to shopping without any parking meters and all that fuzz. But alfa-cyclists are the worst. They are competing at 40 mph and always acting rudely to get where they are going.

A PRO-CAR CYCLIST WRITES: 12-1pm tomorrow on #R4, will be talking bikes, cars, pedestrians, public transport – and #JeremyVine

Stimulating piece on the #CrisisOfCustomerService by clever @ClaerB @FT.

All that Clinton-era #CustomerExperience guff was always for the birds - certainly compared with, er, price.

The new thang? Often there is NO service - and thus no #CX!

Articles grouped by Tag

Bookmarks

Innovators I like

Robert Furchgott – discovered that nitric oxide transmits signals within the human body

Barry Marshall – showed that the bacterium Helicobacter pylori is the cause of most peptic ulcers, reversing decades of medical doctrine holding that ulcers were caused by stress, spicy foods, and too much acid

N Joseph Woodland – co-inventor of the barcode

Jocelyn Bell Burnell – she discovered the first radio pulsars

John Tyndall – the man who worked out why the sky was blue

Rosalind Franklin co-discovered the structure of DNA, with Crick and Watson

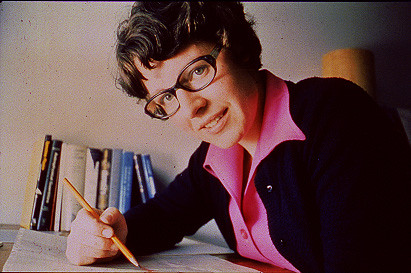

Rosalyn Sussman Yallow – development of radioimmunoassay (RIA), a method of quantifying minute amounts of biological substances in the body

Jonas Salk – discovery and development of the first successful polio vaccine

John Waterlow – discovered that lack of body potassium causes altitude sickness. First experiment: on himself

Werner Forssmann – the first man to insert a catheter into a human heart: his own

Bruce Bayer – scientist with Kodak whose invention of a colour filter array enabled digital imaging sensors to capture colour

Yuri Gagarin – first man in space. My piece of fandom: http://www.spiked-online.com/newsite/article/10421

Sir Godfrey Hounsfield – inventor, with Robert Ledley, of the CAT scanner

Martin Cooper – inventor of the mobile phone

George Devol – 'father of robotics’ who helped to revolutionise carmaking

Thomas Tuohy – Windscale manager who doused the flames of the 1957 fire

Eugene Polley – TV remote controls

0 comments